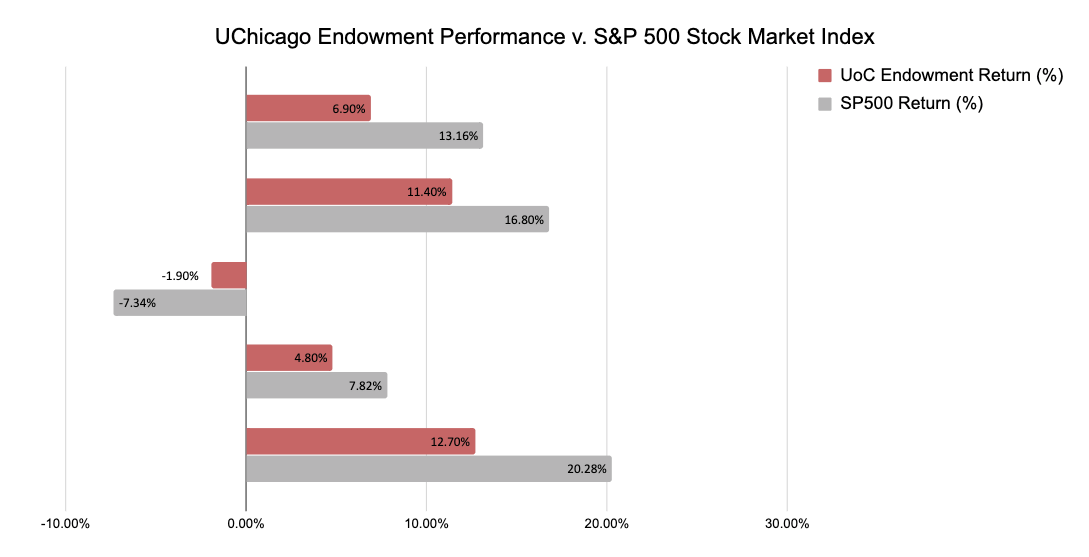

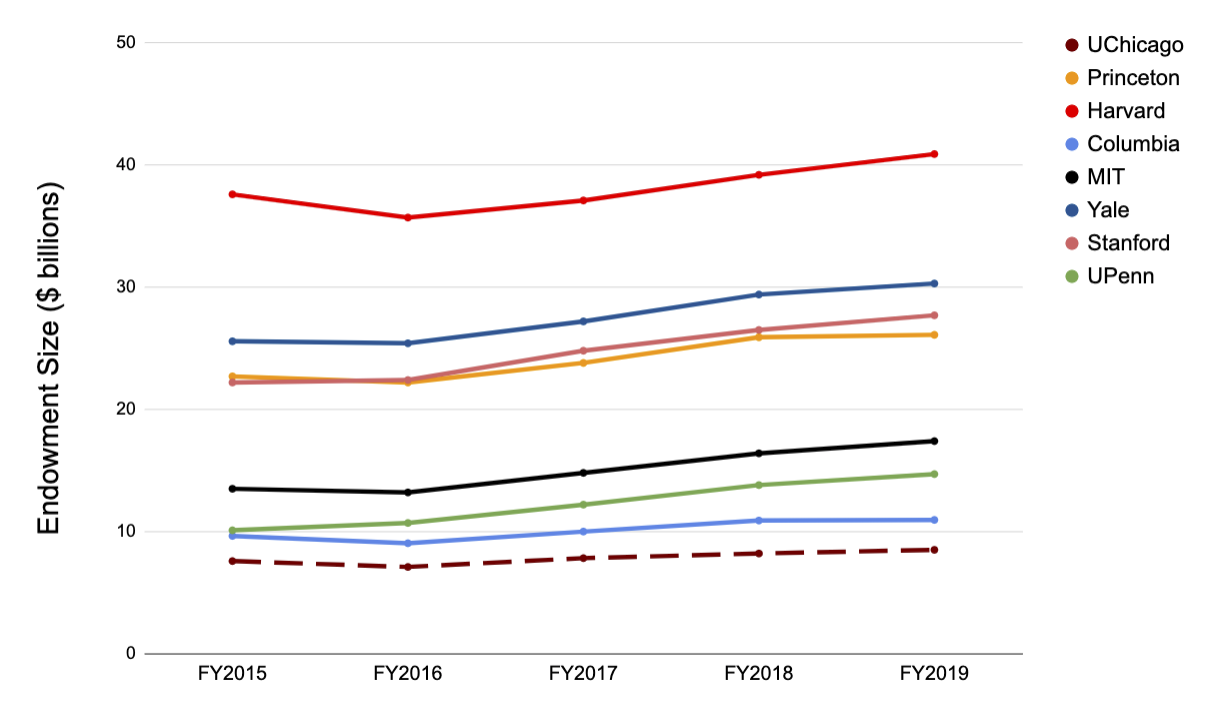

The University of Chicago’s endowment grew by $300 million to $8.5 billion from June 2018 to June 2019, following a 6.9 percent return in the 2019 fiscal year.

Compared to last year’s return rate of 8.0 percent, this year’s return represents a 1.1 percent drop in performance. Despite this, the value of the endowment has reached an all-time high at $8.5 billion, fueled in part by an average 9.3 percent yearly return in the one-decade period between today and the 2008–09 financial crisis.

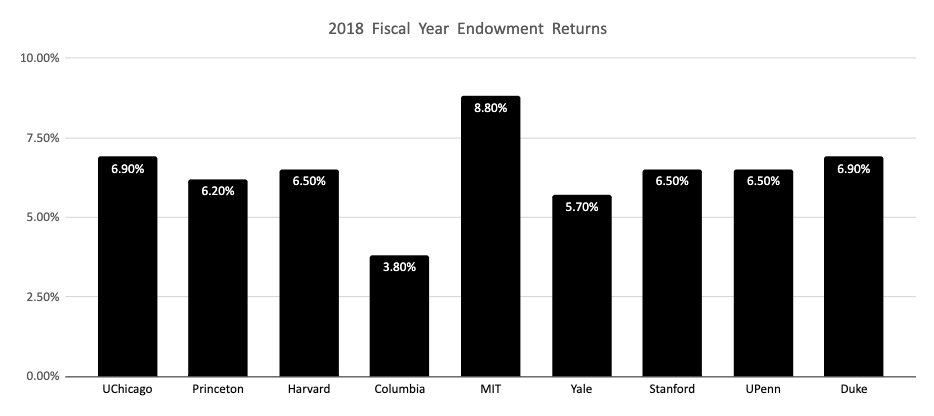

The University of Chicago’s endowment outperformed or matched that of several peer schools.

Duke University’s fund grew at an equivalent 6.9 percent. Harvard University and Stanford University both reported endowment returns of 6.5 percent. Yale University’s endowment returned 5.7 percent. Columbia University reported a 3.8 percent return.

UChicago’s Office of Investments shares basic details about its investment strategy online. According to its Long-Term Investment Policy, the endowment is divided 30 percent into global equities; 14.5 percent into private equity; 4.5 percent in private debt; 25 percent in absolute return; 8 percent in real estate; 7.5 percent in natural resources; 8.0 percent in fixed income; 2.0 percent in Total Return Investment Pool protection; and 0.5 percent in liquid cash and equivalents.

The University of Chicago’s endowment, at $8.5 billion, is now more than eight times larger than its $1.1 billion asset value 25 years ago.