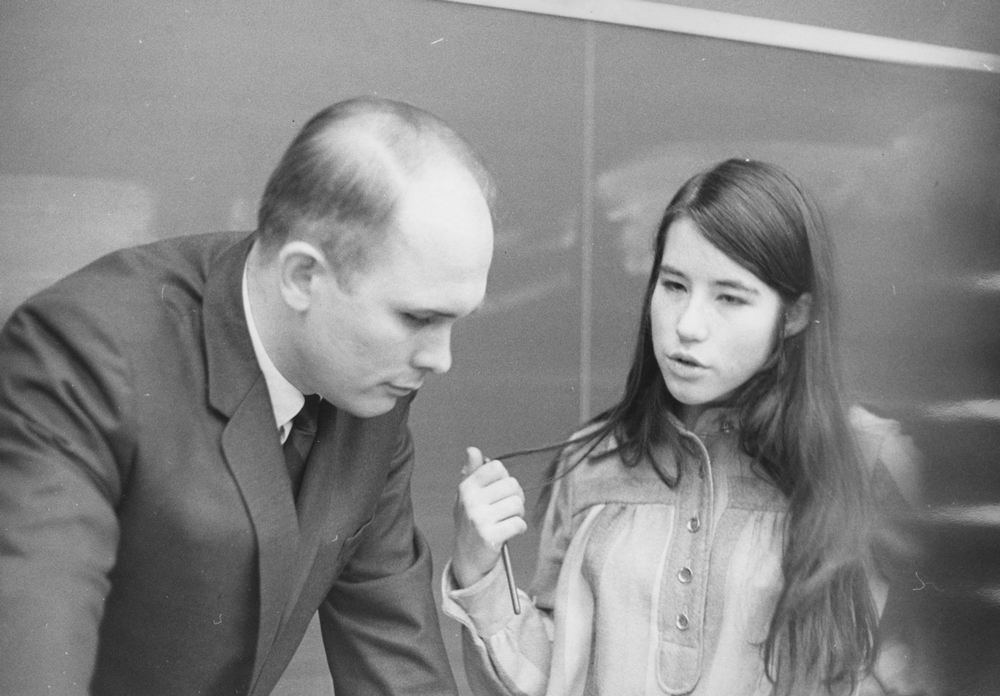

The American Investment Fellows (AIF) held the first annual Investment Pitch competition and forum Wednesday in the Ida Noyes Cloister Club, where teams from King College Prep High School presented investment portfolios they had been developing with mentors to a team of five judges. The two competing teams, The Three Buffetteers and Team Bull Market, were judged on a point scale and tied for first place.

Also included in the program was a speech by Ted O’Neill, dean of admissions at the U of C, and a keynote address by David Oser, who is the chief economist at Shorebank.

AIF, which was formed this year by four U of C students, aims to teach underprivileged teens the basics of the investment world and the value of saving and investing by pairing students with mentors and building mock portfolios.

The Three Buffeteers had a slightly more aggressive portfolio, with stocks like Nike, Wal-Mart, and Google in addition to some bonds and commodities. Team Bull Market held stocks in Safeway and Apple in addition to US Treasury bills.

The panel of judges consisted of economics professor Allen Sanderson, Shorebank CFO George Surgeon, Federal Reserve Bank of Chicago economist Maude Touissant-Comeau, manager of economic development for Programs for Chicago United Salvador Bayron, and former vice president of Devers Group Inc. Connie Falcone.

The judges applauded the contestants for their presentation, but gave some financial advice. Since the students were only sophomores in high school, they recommended they be more aggressive and focus on stocks and commodities, which are more volatile markets.

Veyoncte Griffin, one of the competitors at the event, praised the program. He cited the mentors as teaching him things he didn’t know about before, like commodities investment and mutual funds. “I’ll be very interested in coming back next year,” said Griffin.

“They have been working really hard since January,” said Greg Nance, one of the founders of the club that led the event. “It is really exciting to see all of that hard work coming through for them.”

In his keynote address, Oser encouraged the students. “It is important to get this kind of thought out, and to understand what you’re investing in,” he said. He added that studies had shown that rates of saving and investment in children were directly correlated to those of their parents, and that organizations like AIF were needed in places where that example of financial responsibility might be lacking.

AIF will be expanding in the fall, with programs in at least 15 schools. Currently, 40 mentors and nine College students travel to five Chicago Public Schools on a weekly basis.