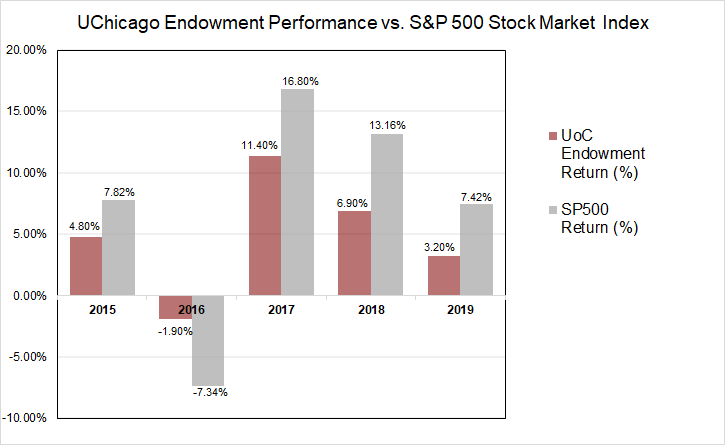

The University of Chicago endowment grew by only 3.2 percent to $8.6 billion from June 2019 to June 2020, a sharp decrease from the previous year’s 6.9 percent returns.

This year's growth represents an underperformance from an endowment that has averaged 7.7 percent returns in the previous decade. The decline is largely due to volatile market conditions caused by the COVID-19 pandemic, which resulted in flat performance of global stocks, a key component of the endowment.

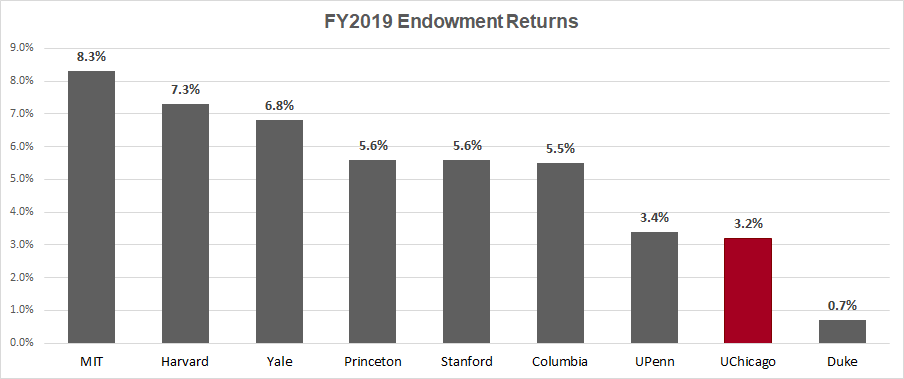

The University of Chicago’s endowment also underperformed relative to its peer schools this year.

Harvard University reported 7.3 percent returns, Princeton University and Stanford University each reported 5.6 percent annual returns, and MIT reported 8.3 percent returns. Among a selection of peer schools, UChicago’s endowment only outperformed that of Duke University, which had 0.7 percent returns.

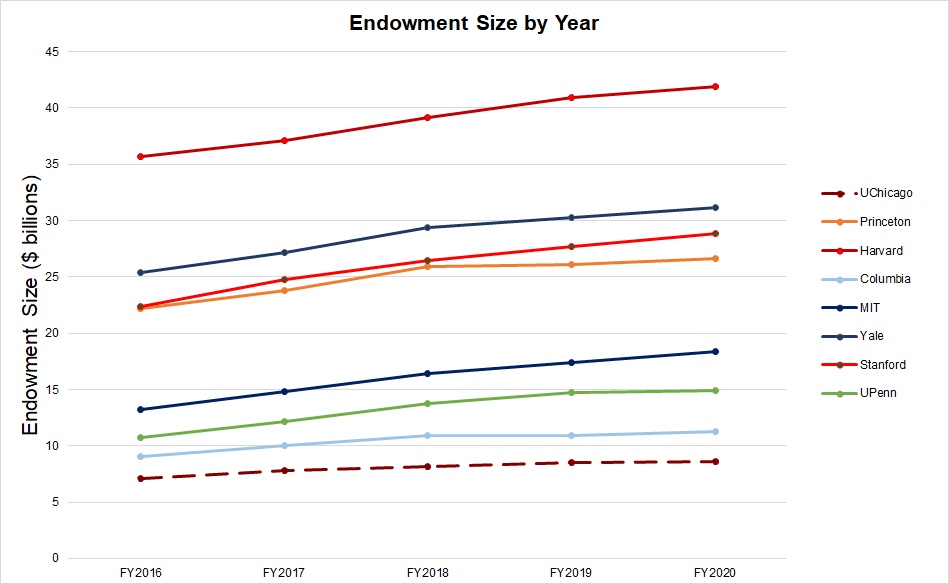

Despite this drop in performance, the value of the endowment reached an all-time high at $8.6 billion, largely the result of an 8.9 percent average annual return in the years between the 2008 recession and 2020. During this period, the University’s endowment increased by $6 billion.

UChicago’s Office of Investments, which manages the University’s endowment, outlines its Long-Term Investment Policy as follows: 42.5 percent in global equities, 17 percent in private equity, 3 percent in private debt, 18.5 percent in absolute return, 7 percent in real estate, 7 percent in natural resources, 6 percent in fixed income, and 2 percent in Total Return Investment Pool protection; and –3 percent in cash and equivalents.