Graduate students may find some relief today with news that the House’s tax on tuition waivers will not make the final version of the GOP tax reform plan.

Details of the final bill have been coming out in media reports, though there’s been relatively little attention on the House’s tuition waiver proposal. Bloomberg first reported earlier today that it looked like the proposal to tax graduate tuition waivers as income would not be in the final bill.

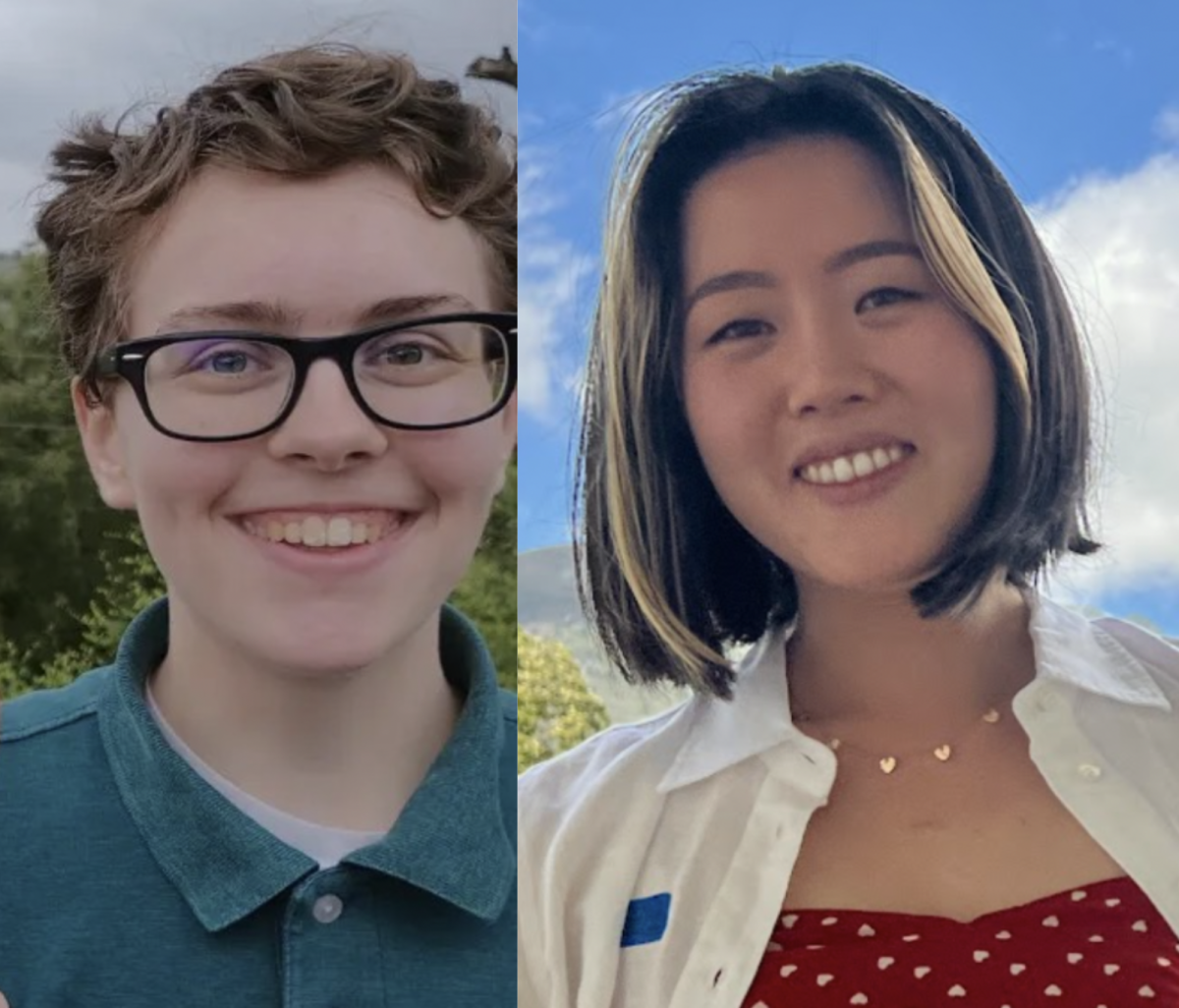

Caroline Boothe, the communications director for Rep. Pete Sessions (R-TX), confirmed to The Maroon that congressmen are hearing the House provision—which was absent from the Senate bill—will not make the final plan. Sessions had authored a letter last week opposing the provision that was cosigned by 31 House Republicans.

“We are being told that the tax on grad students will not be in the final bill,” Boothe wrote in an e-mail.

Update: Responding to an earlier inquiry about the University’s plans if the provision were to become law, a spokesperson issued the following statement Friday afternoon on behalf of the University:

Preliminary media reports are claiming that the tax targeting graduate students will not be included in the final version of the tax legislation. The continuous efforts of the University of Chicago and other universities, as well as graduate students here and across the country, have made an impact and we will continue working to ensure the best possible outcome for our graduate students.