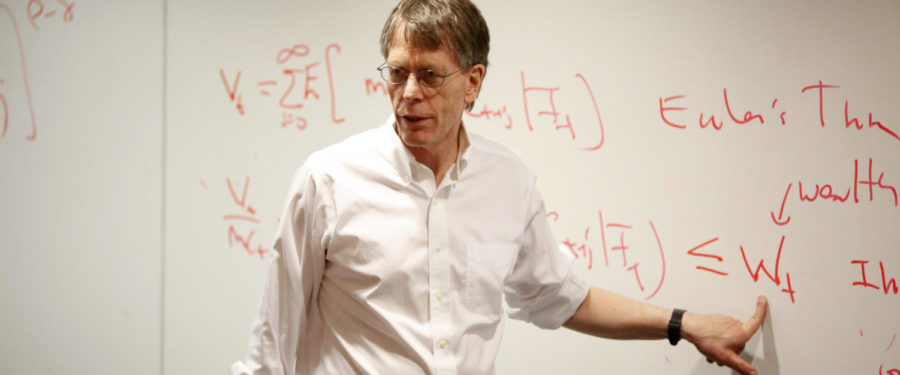

University of Chicago economics professor Lars Peter Hansen published a paper in September questioning the policy toolkit available to central banks in response to the risk posed by the threat of climate change. The paper, titled “Central Banking Challenges Posed by Uncertain Climate Change and Natural Disasters,” highlights concerns regarding the distancing of central banks from the political arena, the accuracy of stress tests, and the effectiveness of monetary policy in lowering carbon emissions when compared to the capability of fiscal policy.

“[There are] concerns that the whole financial sector or banking sector might underestimate the consequences of climate change, which will have systemic implications,” Hansen said in an interview with The Maroon. “I think it's helpful for people to be thinking through these issues in a really serious way. The challenge is acquiring some type of expertise on both the climate side and on the economic side. There's a general willingness to try to piece these together in intelligent ways.”

Mark Carney, U.K. Prime Minister Boris Johnson’s finance adviser for the United Nations Climate Change Conference (COP26) and the former governor of the Bank of Canada and the Bank of England, is pushing banks and other financial institutions to shift their investments to eco-friendly businesses and to play a larger role in reducing climate change in general. As world leaders gathered in Glasgow, Scotland, for COP26 to discuss climate policy, Carney announced a new coalition of financial companies dedicated to hitting net zero emissions by 2050. This coalition of 450 banks, insurers, and asset managers across 45 countries committed $130 trillion of private capital towards meeting their emissions goal.

Hansen, however, advocates for fiscal policy—government spending and taxes—as opposed to central bank monetary policy as the best strategy for tackling climate change. He pointed out that carbon taxation and investments into green technology have proven to be effective fiscal policies. Hansen believes that monetary policy aimed at reducing climate change could jeopardize the reputations of central banks and further reduce the banks’ distance from the influence of politicians.

“[Central banks] can't be completely distant, even in the U.S.A.,” Hansen said. “The head of the Federal Reserve is appointed by the president with [the] approval of Congress, but having some distance, I think, has proved to be valuable. Different central banks have different amounts of political involvement, so it's not some kind of unified model that applies across all central banks. But I do think that you want to be a little bit cautious in terms of pushing central banks more and more into the political arena because I think there's some healthy aspects to having some distance there.”

Hansen asserts that the appeal of monetary policy stems from the difficulty of passing climate-friendly policies, such as carbon cap and tax policies. However, he believes that the reputational risk for central banks associated with climate-related monetary policy is due to the lack of data surrounding the long-term impact of climate change on financial institutions and the most effective financial policies to counter it.

“Climate change is a particularly challenging piece of [policymaking] because we clearly have lots of scientific evidence for a human impact on the environment and the climate system,” Hansen said. “But the quantitative magnitudes are where the uncertainty shows up. The social and economic consequences of [climate change] are important areas of uncertainty as well.”

Although Hansen recognizes the challenges of uncertainty and reputational risk faced by financial institutions, he describes a trade-off between uncertainty and timeliness. As time progresses, clearer data becomes available, but the window to act becomes smaller. This tradeoff, according to Hansen, could be evaluated through the lens of decision theory—the study of an individual’s choices under uncertainty that optimizes best guesses over possible bad outcomes.

“There's this naive notion that if you don't know things, you should just wait until you figure them out,” Hansen said. “That’s some people's argument for delay. From the standpoint of decision theory under uncertainty, that’s not the right way to go about things because there may be a cost to delay and maybe much more. It may be much less costly to act now rather than wait until we know everything.”

In order for central banks to craft effective climate policy, Hansen stresses the need for quantitative modeling to guide decision-making and the distancing of bank policies from politics. In particular, Hansen emphasizes “quantitative storytelling,” whereby models tell predictive stories of policy outcomes. Central banks already use quantitative models successfully to guide their policies on inflation and employment. These successes do not necessarily translate to positive climate policy given a lack of data and uncertainty.

“We use models to try to help us think about what are sensible and fruitful policies,” Hansen said. “So we can imagine using the model to kind of tell a story. We can use quantitative models to try to tell stories that have an additional quantitative component to them about the impact of policies.”

Many central banks already use climate stress tests, an analysis meant to determine whether the bank is capable of withstanding an economic crisis resulting from climate change. These tests, according to Hansen, are not dependable for accurately quantifying climate exposures as they generally only assess instantaneous risks and ignore disruptions that play out over a longer time horizon.

“The way they're doing [stress tests] is through projecting out 30-year deterministic scenarios. I think better ways to proceed have to do with thinking about this through tools you learn about in statistics, probability theory, and economics,” said Hansen.

From a policy standpoint, Hansen encourages collaboration between central banking research departments, private bank risk assessment teams, and related academics in evaluating climate change uncertainties. Central banks already coordinate their policies in relation to climate change through the Network for Greening the Financial System (NGFS), which encompasses a global network of more than 100 members and 16 observers that includes central banks and financial supervisors. Many individual central banks also invest in climate expertise and research departments that influence policy decisions. Hansen feels optimistic about this level of collaboration, but he expressed concern that central banks may rush their policy decisions.

“There's some collaboration going on now, but I don't think it's quite directed in the best way yet,” he said. “Central banks have had a history of wanting to connect to academic-style researchers. And no doubt they have direct communications with the private sector through their regulatory roles and their supervisory roles. So they're in a position to help nurture this. My concern is that they want to rush to answers too quickly.”

Hansen noted the positive response to his research paper from both the academic and professional communities. The European Central Bank invited Hansen to give a feature talk at a conference on central bank monetary policy, and he looks forward to future conversations with the Federal Reserve Bank of New York about the intersection of climate and finance.

“The academic community has been largely receptive, but I think there's been a fair bit of head-scratching about what the role of central banking is in terms of climate change,” Hansen said. “The central bank conversations have been interesting in the sense that they're open to it. They think they understand some of these aspects, they still want to do something, they feel political pressure to do something for climate change, and I think many of them are facing a frustration that other parts of government are not acting.”

Beyond crafting policy and conducting academic research, Hansen highlights the role of advocacy in counteracting climate change. Advocacy, in his mind, unites students of varying backgrounds and talents under the common goal of improving the planet and preparing for climate change’s inevitable consequences.

“I think there's lots of people that want to be engaged right now through advocacy and that can be very, very important,” Hansen said. “I think that effective advocacy is supported by a fundamental understanding of things, and I think that there's much more that can be done in terms of the methods associated with modeling skills, data simulation, and thinking cleverly through how to use the data that's out there.”