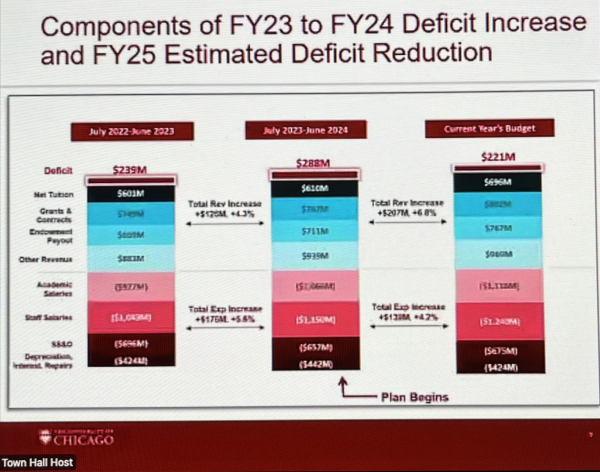

The University’s budget deficit increased from $239 million in financial year (FY) 2023 to $288 million in FY2024, then dropped to $221 million this budget cycle, University Provost Katherine Baicker and Chief Financial Officer of the University Ivan Samstein said at a third invite-only budget town hall meeting this Monday.

At the meeting, they explained that the University’s revenue growth has begun to outpace its expenditure growth, leading to a reduced budget deficit for the July 2024 to June 2025 budget compared to July 2023 to June 2024.

Baicker and Samstein attributed the reduction to the University’s plan to address the severe financial pressures it faces. The four-year budget plan aims to eliminate the budget deficit by 2028.

According to Samstein and Baicker’s presentation, expenditure cuts came from debt refinancing, paring down central administrative expenses, and moderating academic units’ spending by limiting faculty and staff compensation increases. Meanwhile, they attributed much of the increased revenue to successful increases in “campus utilization and enrollment,” philanthropy, and expanded master’s and non-degree program offerings.

The expansion of academic offerings has emerged as a major contributor to recent financial improvement. According to the presentation, the approximately 7,000 students enrolled in non-degree programs brought the University $23 million in revenue in 2023. This fall, about “350 more master’s students” enrolled, “roughly 250 of which enrolled in new programs at Booth and PSD [Physical Sciences Department].”

Baicker added that the growth of enrollment in master’s and non-degree programs not only benefits the University financially but also serves the University’s educational goals. “There are a lot of people in the world who would benefit from some UChicago thinking,” she said. “Having the opportunity to reach more people at scale furthers our mission.”

In addition to its plans for directly targeting revenue growth, the University has also implemented new software to improve efficiency and planning capability. The Financial Systems Transformation (FST) began replacing the University’s previous finance and operations systems in a phased rollout of Oracle Cloud ERP (Enterprise Resource Planning) that began this past February and concluded in August, before the start of the academic year. According to Baicker, it will let the University “provide academic leaders with a multi-year planning horizon.”

“I know I can see deans in the audience, they’re like, ‘I’ll settle for next year. Could you just give me next year?’ But I think we’re actually way ahead of where we were last year in providing next year’s budget,” Baicker said. “And the goal is to provide [the ability to financially plan] a couple of years out… enough of a sense that people can plan accordingly and invest.”

Though Samstein admitted that the University has been facing some growing pains with FST, he expressed confidence that the system’s benefits would soon become apparent.

“Those who lived through large, complex systems transformations like this, [know] you always have some challenges the first six months. We are not immune,” Samstein said. “[Previously] we basically had a 1980s abacus with a bunch of things popped on top of it, and it’s been very challenging… to really know what’s going on in the projected forecast. [So FST] will be pretty significant for us in the long run.”

Baicker highlighted the recent philanthropic support the University had received as well. Since September, they have announced three major donations: an anonymous $100 million donation to the Chicago Forum for Free Inquiry and Expression, a $60 million donation from alumni Clifford Asness and John Liew to Booth’s Master in Finance program, and a $75 million donation from AbbVie Foundation to support the construction of UChicago Medicine’s cancer care and research center.

“We’ve had 150 percent of the typical three-year average of philanthropy over the last two years, so that is a remarkable trajectory and reflects, I think, how exciting the work that we’re doing is here to potential supporters,” Baicker said.

The remaining 20 minutes of the town hall were reserved for a Q&A, during which attendees directed questions toward Baicker and Samstein.

One audience member questioned why the police budget had not been an area to face cuts, saying it was the only unit of the University to be “involved in violence against students” and referencing UChicago United for Palestine’s October 11 rally, during which University of Chicago Police Department (UCPD) officers used pepper spray and batons against students. “I very much disagree with the characterization of the events that you outline,” Baicker responded, “but I will say that we, in thinking about what budget priorities are, very much prioritize everyone’s safety and security, so there was not a cutback in safety and security spending as part of this budget plan.”

Samstein then answered a question about what role the University’s investments play in the plan to reduce debts, saying that the University’s historically “conservative” endowment investment strategy emphasized stability over greater return on investment, unlike many of its peers. He said he saw the endowment investment strategy as “a core element of the long-term prosperity of the institution,” but that it would not be what the University relied on in its financial planning “on a year-to-year income basis.”

Samstein and Baicker also reiterated that the University’s current level of debt was the result of choices it had made to invest in what Baicker called “wonderful things,” including the decision to use a need-blind system of financial aid before its endowment reached the scale of other schools who practiced need-blind admission. Samstein said, “Princeton, Harvard, Yale, Stanford, MIT, they have an endowment of the scale that they could do it without [extra financing], [but] we made… the decision that [beginning need-blind financial aid] was a value statement and critical.”

Another audience member said the University’s 2009 financial plan had been “consistently, wildly rosy” in its estimates compared to reality and asked if the current plan might have similar inaccuracies.

Baicker explained the University was attempting to “learn from what worked in the past and what didn’t work in the past,” adding, “part of what you’re seeing here [in this town hall] is our effort to be really transparent about that.” She said the fact that “we didn’t see a credit downgrade” for UChicago was a testament to the plan’s efficacy and the team working on it. In May 2024, credit rating agency Fitch affirmed UChicago’s credit rating at “AA+”, just below Fitch’s “highest credit quality” rating tier of “AAA”, and revised its rating outlook of the University from “negative” to “stable.”

In his closing remarks, Samstein reiterated the importance of staying proactive with the budget plan to achieve the 2028 goal. “We have to keep executing on this,” he said. “A budget doesn’t make itself.”

Baicker concluded the session by expressing appreciation to the attendees. “Everybody wishes we were in a world where there were not budget constraints, but we have real opportunities here,” she said. “Thanks to everybody’s hard work, we’re now focused on growth and revenue opportunities placed in the plan. I think there’s exciting things ahead.”

Matthew W. / Nov 18, 2024 at 6:19 pm

Not good enough. Still too much bureaucratic fat.

Outlaw and terminate the diversity apparatus:

– Center for Identity + Inclusion

– EEO

– Center for the Study of Race, Politics, and Culture

Fire the following:

– Rebecca Journey

– John Anderson

– Anton Ford

– Graham J. Slater

– and others listed on the University’s D.E.I. homepage and are notorious for using sock puppets to harass those who dissent from their idiotic views.

Publicize their salaries and disclose how much of the university’s operating budget is wasted on positions unrelated to its core academic mission.

Use those funds to lower tuition or invest in real educational resources like research labs and libraries.

Eliminate all funding for student organizations and initiatives that prioritize activism over academics.

Shut down grants, fellowships, and endowments earmarked for “equity” initiatives.

Terminate mandatory bias training, unconscious bias workshops, and any related re-education programs that treat dissenters as heretics.

Audit all course offerings to identify and defund those that prioritize grievance studies over scholarship.

Subject suspected D.E.I.-hire bureaucrats to re-examination to prove their worth.

If any faculty member like is found to be engaging in unethical behavior—sock puppets, ad hominem attacks, or attempts to suppress academic freedom—subject them to immediate disciplinary action and public censure.

You have two choices, Alivisatos: either you can enact these changes, or Trump’s regime will force your hand.

Matthew G. Andersson, '96, Booth MBA / Nov 15, 2024 at 8:18 pm

A good way to assess university finances, is to ask yourself if you would be a shareholder: would you buy the stock of this company issued by these “officers” or administration executives (you may wish to invest in commercialized research, such as Stanford, for example, has organized). That these finance meetings are closed by invitation, appears to indicate that students and others are not so considered, and that a certain amount of administrative self-dealing remains institutionalized. Most colleges and universities will be facing some kind of financial restructuring along with significant and useful changes in their operating methods, which are still not being managed by administrative insiders, as this article underscores (and traditional accounting measurements are designed for manipulation, as most corporations know). The recent change in the political economy does not appear to be favorable for the inefficiencies of the federal and state education system (there is no such thing as a “private” university), including especially, those distortions from the DoE. The new “DOGE” will effectively create the “DOCE” or college efficiency initiative, as national tuition debt tops $2 Trillion. Many traditional education overhead positions like provosts and chancellors, that are “free rider” problems, or market failures, will necessarily be idled. Almost everything that any university does can otherwise be done in half the time, for half the cost, at 80% lower tuition. This report by the provost is unfortunately, status-quo gesturing. Readers may enjoy the Financial Times article, “Overhaul likely to mean business as usual at the University of Chicago.”