[img id=”80795″ align=”alignleft”] Since his death on November 16, 2006, there has been an outpouring of tributes to late economist Milton Friedman. He was indeed a seminal thinker and great American. He was also an effective teacher and understood the value of debate, challenge, and contention. His DNA is all over the University of Chicago’s economics department and has created a loyal following of disciples and worshippers among professors and students.

His most popular economics book, which he penned with his wife Rose, was titled Free to Choose. This title reflected his sentiment toward intellectual self-determination, including the liberty to choose among any number and variation of alternative economic, social, and political systems.

Friedman would likely be just as pleased if all of us held his particular positions with a bit, perhaps much, less veneration. The initiative to create the Milton Friedman Institute may reflect precisely the kind of intellectual rigidity that Friedman would have rejected.

As for an edifice to Friedman, most observers forget that he was a rather different, more flexible economist prior to his Chicago tenure. From 1941 to 1943, for example, he worked for the U.S. Treasury, was a devout Keynesian and supporter of taxation, and helped devise the federal income tax payroll deduction system. He enthusiastically backed Roosevelt’s social programs. Yet while market policy prescriptions subject to “economic reform” erased the retirement benefits of millions of workers, Friedman retained his university pension until the end. As a social thinker, he occupied a position so far to the left (or is it to the right?) that many felt he fully embraced near- anarchical beliefs on drug usage, prostitution, and the draft.

Milton Friedman’s theoretical economic work—which produced various monetary concepts such as the quantity theory of price, the refinements of a general consumption function, and the permanent income hypothesis—was intriguing but still largely theoretical. Some were not entirely original, dating as far back as the 16th century in various schools of social thought. Moreover, several historians and economists have provided compelling evidence of non-monetary factors that point to an entirely confrontational source concerning the underlying determinants of output. Still others have advanced observations of how people really behave, contrary to the rational utility maximization theory which underlies all of Friedman’s work, that of his colleagues, and of course the entire “Chicago School.”

Perhaps the perceived legacy he has left that is most troubling—and most deserving of head-on sustained challenge—is the “pretension to universality” of so-called neoliberal economics: that free markets alone can ultimately solve all industrial and social challenges. Indeed, Friedman and his followers so abstracted economics that in their theories actual societies, industries, and specific social and political issues are made entirely—and perhaps dangerously—inert in an effort to perfect and solve a theoretical economic construction, interesting for university consumption but misleading, if not destructive, when translated blindly into actual policy. One need only look at the effects of bald deregulation, privatization, and liberalization across several unique industries, including telecommunications, energy, and airlines, for evidence of the incompleteness of market liberalism. Friedman was by no means the only or best advocate of these theoretical and normative concepts, but he is somewhat lazily attributed with being their spiritual leader, stemming in part from his loud and obstinate proselytizing and promotion. Perhaps at heart Friedman was just a darn good marketer.

Unfortunately, many uninformed members of the political class continue to blindly embrace the slogans of neoliberal economics as a near religion, unassailable and beyond reproach. Other societies have considered alternatives: The World Bank ranks Norway and Sweden as the most advanced countries in the world. Meanwhile, the U.S., obsessed with free markets, continues to ignore its infrastructure modernization demands; relatedly, Standard and Poor’s predicts U.S. debt may be junk by 2030.

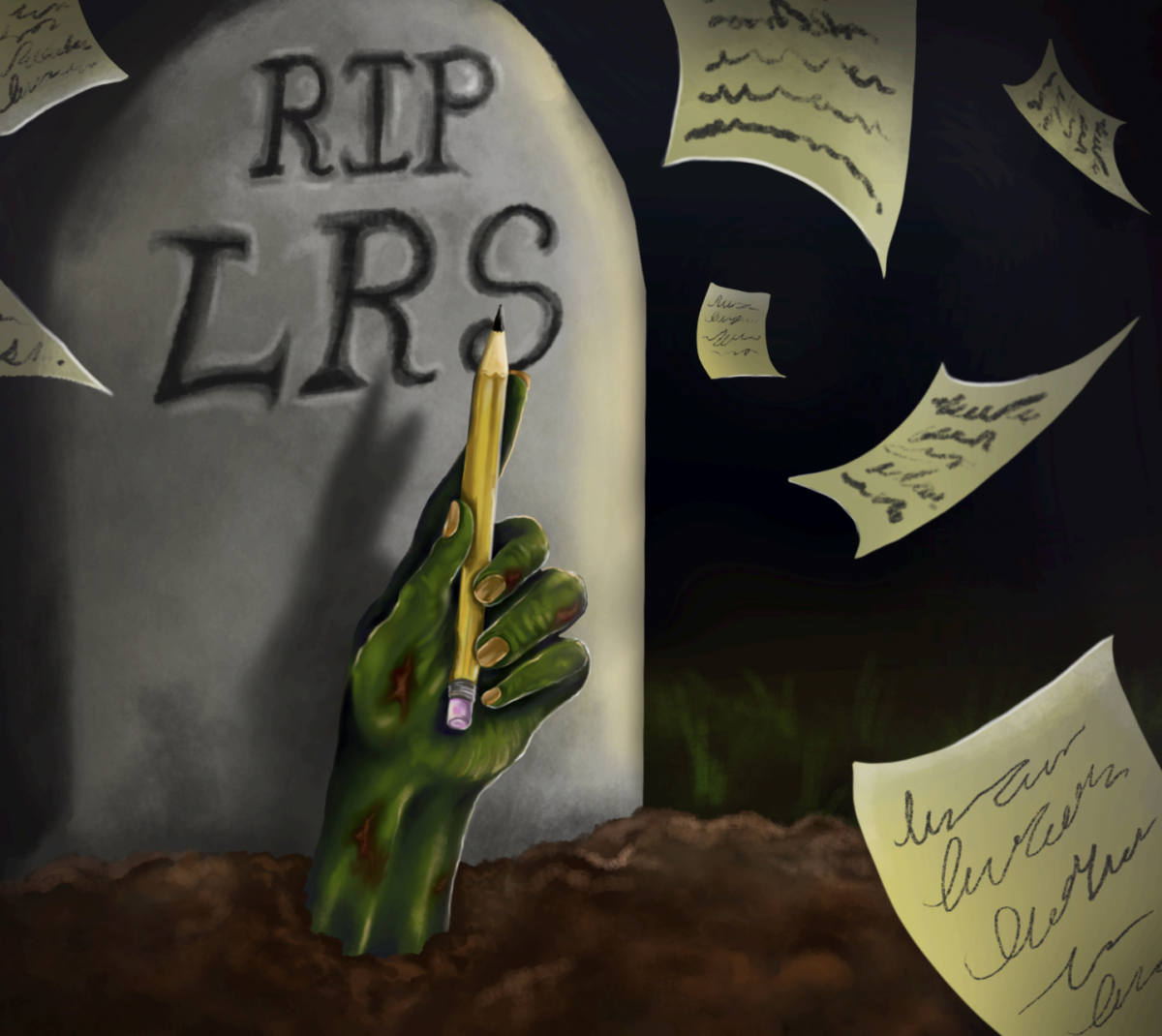

As for an institute, Friedman is likely turning in his grave at the thought of blind obedience to any of his organized thoughts. The highest honor any of us could give him and dozens of other now- deceased economists is a thorough, aggressive, irreverent, and unending challenge to every assumption, application, and result of those activities that we call economics. More than just a challenge, the organization and further refinement of fundamentally different social and economic frameworks mark the kind of intellectual freedom Friedman likely most revered. That doesn’t suppose a ritualistic institution, but rather its complete opposite: an unbounded horizon of exploration.

The economic and academic community, the government, and the public in particular may have been given the best, perhaps quietly overlooked legacy of this one man—the power indeed of the freedom to choose.

Matt Andersson received his M.B.A. from the Graduate School of Business in 1996.